Sales Tax / VAT / GST

We are required to charge value-added tax (VAT) on certain products and services supplied to clients within the United Kingdom (UK). We are also required to charge local VAT on electronic services supplied to clients in the European Union (EU).

Other supplies to customers outside the EU will usually be free of VAT at the point of sale, but may be subject to any local VAT (or GST/sales taxes) applicable in their country and/or other customs duties or tariffs.

Our online store displays prices exclusive of VAT. The current rate of VAT in the United Kingdom applicable to teaching materials and online training services is 20%. VAT is also charged on delivery fees. There is no VAT charged on printed books.

If VAT is due on and order, it will be added during the checkout process after the delivery location and billing address is confirmed.

Tax relief on purchases of printed See and Learn teaching materials for UK clients

We are able to supply See and Learn kits free of VAT to families and charities in the United Kingdom for use with children with Down syndrome (or children with similar disabilities).

Specifically, we are permitted to supply See and Learn teaching materials free of VAT only if the following conditions are met:

- the item(s) are supplied for use with a child (or children) with Down syndrome or a condition resulting in similar disabilities likely to be assisted by the materials;

- the item(s) are being purchased specifically for use only with the disabled child or a group of disabled children and not for business or other purposes (such as by other non-disabled children); and

- the item(s) are supplied to the disabled child's family; or the item(s) are supplied to a charity within the UK to make available for a disabled child for their personal use

Please note that these requirements imply:

- Parents (or family members) must purchase the items for delivery to their home address to qualify for tax exemption.

- Schools in the UK (that are not charities) cannot purchase the items and claim exemption as a parent.

- Schools and charities outside the UK cannot claim tax exemption.

For more detailed guidance about eligibility for tax relief, please refer to VAT Notice 701/7: VAT reliefs for disabled and older people.

Tax relief on other products and services

Please note that the tax relief only applies to printed See and Learn teaching materials. We are unable to zero-rate the supply of See and Learn apps sold through app stores. Nor are other taxable items (for example, online courses, DVDs, PDF ebooks and checklists) eligible for tax relief.

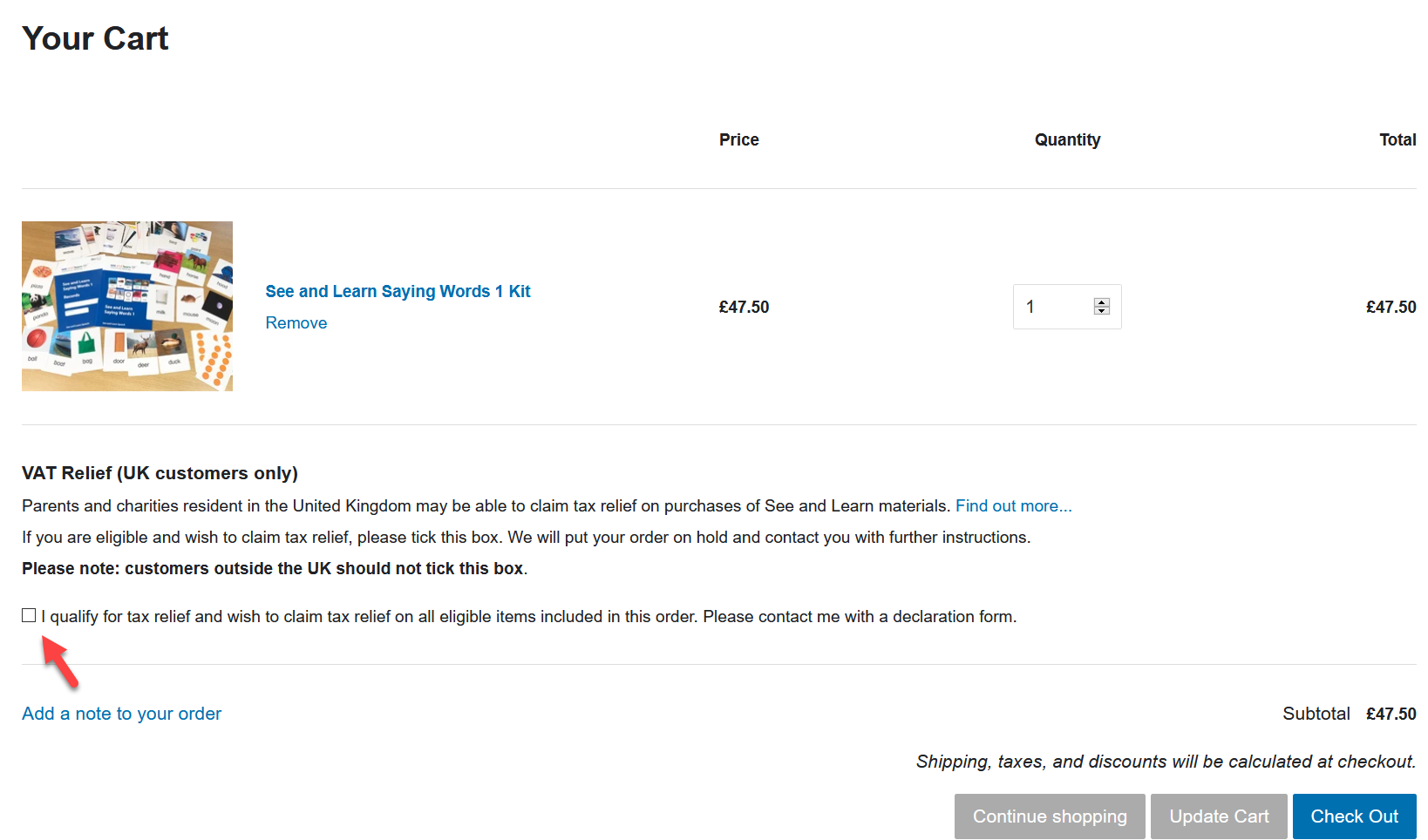

How to claim tax relief on See and Learn kits when ordering

To claim tax relief, place your order via our UK online store. When you checkout (if your basket includes eligible items), an option to request tax relief will be shown. Check the box to claim tax relief:

Then, continue to checkout and provide payment as usual.

Note: At first, VAT will not be deducted from your order. We will adjust your payment and deduct the VAT when you have completed the tax relief declaration.

After you checkout you will receive an email from us with a link to an online declaration form where you can confirm your eligibility for tax relief. When you have completed and submitted the form, we will amend your order and ship the items to you.

Further information

If you have any questions, please contact us at hello@dseinternational.org